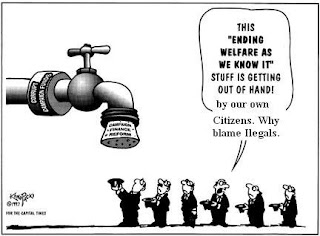

Nativists, and Anti Immigrants. What part of Ilegal you do not Understand.!!!!!!!!!!!!

Nativists, and Anti Immigrants. What part of Ilegal you do not Understand.!!!!!!!!!!!!

Most of Nativists, Anti Immigrants found that Undocumented(Ilegal) Immigrants were mostly a drain. Well Just Ilegal Billing, Ilegal fraud, ilegal benefits entitled to, ilegal claim, ilegal Kickbacks, Ilegal charges for services do not rendered to patient,

But they found greater ambiguity on whether Undocumented immigrants are good or bad for American society because they do not see the real facts. They rather create waves of flames of Anti Immigrant sentiment to our Society to see Undocumented people as a bad people.

Undocumented Immigrants has been persecuted, scapegoated, dimished, criminalized and labeled as a problem on Social Services specially Healthcare Services like Medicare and Medicaid. Well lets see the real facts.!!!!!!!!!!!!!!!!!!.False Claims Act Returns $2 Billion in FY 2007.

The Justice Department has announced that $2 billion has been recovered under the federal False Claims Act in Fiscal Year 2007, of which $1.45 billion came from whistleblower-filed cases. The total amount returned to the U.S. Government under the False Claims Act since 1986 is well over $20 billion. Department of Justice data is actually very conservative, as it does not include billions of dollars in civil recoveries returned to the states or criminal fines imposed as a direct consequence of False Claims Act filings and prosecutions.

The cases below represent a "running tally" of False Claims Act cases compiled by the Taxpayers Against Fraud Education Fund for Fiscal Year 2007.

Amount in Millions $ Date Nature of the fraud Medicare Medicaid.

Bristol-Myers Squibb 328 9/28/2007 A total $515 million settlement, with $328 million to be paid under the Federal False Claims Act, and the state's getting $187 million. Fraud charges included off-label marketing, kickbacks, AWP drug pricing violations and several other frauds involving 50 drugs and a total of seven qui tam cases.

Amerigroup 172 3//14/2007 Judgment for $334 million including penalties. Amerigroup cherry-picked patients in violation of its HMO Medicaid contract, purposely avoided women in their third trimester of pregnancy because they cost more to insure. Note that this judgment is on appeal and reflects a $190 million penalty on top of a $144 million jury verdict.

Combined settlement with four orthotics companies:

Smith & Nephew, Biomet, Zimmer, DePuy (Johnson & Johnson) 310 9/27/2007 $310 million total settlement of broad practice of kickback in the orthotics industry. Zimmer to pay 169.5 million, DePuy to pay $84.7 million, Smith and Nephew to pay $28.9 million, Biomet to pay $26.9 million. Stryker agreed to be monitored, but has entered no civil settlement.

Aventis (sanofi-aventis) 180 9/17/2007 Medicaid Average Wholesale Price case involving the anti-nausea drug Anzemet. Total settlement was for $190 million

Medco 155 10/24/2006 Shorting prescriptions, canceling prescriptions to avoid paying non-performance penalties, soliciting and accepting kickbacks from pharmaceutical manufacturers to favor their drugs, and paying kickbacks to health plans to obtain business. X X

Purdue Pharma 140.5 5/10/2007 Company "mislabeled" the drug saying it was less addictive than it was. This is a $634.5 million settlement, with $276 million to be forfeited to the United States, $160 million allocated to federal and state government agencies to resolve false claims for government healthcare programs and $130 million will go to resolving private civil claims. Of the 160 million to go to State and Federal FCA claims, $19.5 million is to go to the states.

Bill L. Harbert-owned construction companies 102 5/15/2007 Bid rigging for US AID paid for water and sewer systems installed in Egypt in the 1980s as part of the Camp David peace accords.

Oracle / PeopleSoft 98.5 10/10/2006 Provided false pricing information to GSA to obtain a federal contract.

ConocoPhillips 97.5 8/15/2007 Underpaid royalties owed on natural gas produced from federal and Indian leases

Omnicare / Specialized Pharmacy Services (Michigan) 52.5 10/5/2006 Improper billing, failure to credit Medicare for returned drugs, billing drugs for dead patients. X

Omnicare 49.5 11/14/2006 Illegal switching of generic pill to capsule forms of Zantac (ranitidine) in nursing homes and other facilities.

InterMune, Inc. 36.8 10/27/2006 Illegal off-label promotion of Actimmune. X X

Lourdes Perez, Provident Home Health Care Services Inc. and Tri-Regional Home Health

Care Inc. 33.8 10/11/2006 Medicare "bill mill" in which Medicare was billed for patients who were not homebound and for services her companies did not perform, creating false medical records to support the claims. X

Maximus Inc. 30.5 7/24/2007 Maximus billed DC Medicaid for targeted case management services that it either did not provide or had no records for.

Kerr-McGee Oil 30 1/25/2007 Jury verdict on case involving Kerr-McGee cheating the government out of millions of dollars in royalties on oil it produced in publicly owned coastal waters.

Robert I. Bourseau, Dr. Rudra Sabaratnam, and their two single-employee corporations, RIB Medical Management Services, Inc., and Navatkuda, Inc., 23.8 10/2/2006 Used false cost reports to bill Medicare for unreimbursable services at the Chula Vista psychiatric hospital formerly known as Bayview Hospital & Mental Health Systems. X

Akal Security Inc 18 7/13/2007 Akal violated terms of its contract to provide trained civilian guards at eight U.S. Army bases.

Harris County Hospital District 15.5 3/28/2007 Medicare Secondary Payer violations plus billing Medicaid for patients under custody of law enforcement.

Larkin Community Hospital in Miami and its current and former owners, Dr. Jack Michel, Dr. James Desnick, Morris Esformes and Philip Esformes 15.4 11/30/2006 Kickbacks X X

Aggregate Industries 15 7/27/2007 Total settlement of $50 million, of which $27 million will go into a special fund to be used to pay for future maintenance and repair of the Big Dig highway project, and an additional $8 million will be paid in criminal fines.

Jackson Memorial Health System 14.25 12/20/2006 Jackson Memorial was deliberately making use of unallowable or reopened cost reports, getting wrongful overpayments as a result. X

Ajax Paving Industries Inc. and Dan's Excavating Inc. 11.75 3/16/2007 Knowingly violated Disadvantaged Business

Enterprise (DBE) contracting requirements for federally funded construction

projects at Detroit Wayne County Metropolitan Airport

Cell Therapeutics 10.5 4/18/2007 Off-label marketing of Trisenox billed to Medicare.

Intergris Baptist Medical Center 10 11/28/2006 Inflated costs for organ transplants

Emory Worldwide 10 11/14/2006 Inflated bills for handling priority mail for USPS

Medicis Pharmaceutical 9.8 5/8/2007 Off-label marketing: Company promoted the use of a topical anti-fungal, Loprox, for diaper rash on children under the age of 10, without approval by the Food & Drug Administration.

American Medical Response Inc. 9 10/5/2006 Ambulance services fraud. X

KBR Inc. 8 11/29/2006 Overcharged the U.S. Army for logistical support in the Balkans during 1999 and 2000

Crane Co.

7.6 8/14/2007 Substandard valves sold to the U.S.

SCCI Health Services Corporation, and its subsidiary, SCCI Hospital Ventures Inc 7.5 1/7/2007 Kickback and self-referral (Stark violations) X

Raritan Bay Medical Center 7.5 3/16/2007 Purposefully inflated outlier charges for inpatient and outpatient care to make these cases appear more costly than they actually were.

PBSJ 6.4 1/25/2007 PBSJ submitted claims to the overstated overhead rates in its Government contracts.

Atlanta's Northside Hospital 5.75 10/20/2006 Kickbacks

Oakland City University 5.3 7/31/2007 University paid incentives to admissions recruiters contrary to federal regulations.

IBM & PriceWaterhouseCoopers 5.2 8/16/2007 Companies solicited and provided improper payments and other things of value on technology contracts with government agencies

Keystone Mercy Health Plan 5 10/27/2006 Medicaid HMO Kept Medicaid overpayments X

Cook County, Illinois 5 12/20/2006 County mismanaged a federally funded study involving pregnant drug addicts.

AIT Worldwide Logistics of Itasca, Ill. 4.2 10/20/2006 Kickbacks and bill padding.

St. Elizabeth Regional Medical Center (NE) 4 10/31/2006 Used false cost reports to overbill l Medicare for neonatal and burn units.

Scooter Stores 4 5/14/2007 Settlement includes $4 million in cash and $13 million in foregone Medicare payments to settle charges the company billed Medicare medically unnecessary power wheelchairs.

HealthSouth Corporation 4 11/3/2006 HealthSouth submitted fraudulent Medicare claims for prosthetic and orthotic devices - such as artificial limbs and braces - used to treat HealthSouth hospital inpatients X

Our Lady of Lourdes Regional Medical Center 3.8 5/9/2007 Billing Medicare, Medicaid and private insurance providers $2.5 million for unnecessary cardiac procedures, such as angiograms and angioplasties, on more than 70 patients.

Orphan Medical/ Jazz Pharmaceuticals Inc 3.75 7/13/2007 Aggressive marketing of Xyrem (GBH, the "date rape" drug) for unapproved use. Part of a total settlement of $20 million, including criminal.

Cabrini Medical Center 3.4 3/29/2007 Kickbacks billed as administrative services for referral of patients.

Korrect Optical 3.25 1/25/2007 Korrect Optical submitted false claims to the

Department of Veteran Affairs ( VA )through ophthalmic prescriptions for eyewear for veterans.

Dr. Daniel Nixon and other board members of the Institute for Cancer Prevention, Tatum, LLC and Weiser, LLP 3.2 1/17/2007 Unlawful receipt and use of federal grant money.

Electronic Data Systems Inc. and Travelers Casualty 2.85 1/23/2007 EDS was processing National Flood Insurance Program claims based on backdated policies written by Travelers.

Dey 2.8 4/26/2007 Settle charges of price inflation and defrauding Mass. Medicaid program (AWP).

Rural/Metro Corporation 2.5 6/11/2007 Kickback for referrals

David Rommel 2.48 11/13/2006 Dental practice fraud. Won by summary judgment.

Danbury Hospital (CN) 2.4 10/27/2006 Self-reported upcoding for septicemia, respiratory failure, respiratory infections and inflammations. X

Affiliated Computer Services, Inc 2.3 7/2/2007 ACS allegedly Submitted inflated claims for programs run by and through the U.S. Department of Agriculture (USDA), the U.S. Department of Labor (DOL), and the Administration for Children and Families of the U.S. Department of Health and Human Services. Self reported.

APAC Atlantic 2.25 10/3/2006 False asphalt testing

University of Miami Medical School 2.2 12/27/2006 UM sometimes billed for critical care services when patients were not critically ill or where critical services were not rendered. X X

Loma Linda Behavioral Medicine Center (Loma Linda BMC) in Redlands 2 4/26/2007 Fraudulently overbilled federal health insurance programs by manipulating cost reports.

O'Hara Regional Center for Rehabilitation, Health Care Management Partners, ORCR Inc., Solomon Health Management, Solomon Health Services 1.9 10/5/2006 Abuse and neglect and substandard nursing home services. X

Emeritus Corp 1.86 8/30/2007 False and inaccurate billing to the Texas Medicaid program.

COSMOS Corp 1.5 1/23/2007 COSMOS improperly charged government contracts for costs that dealt with the company's operations, and also shifted labor costs from private contracts to government contracts.

Crawford and Company 1.36 10/11/2006 Billing the government for health care services to federal employees at rates set by Crawford managers, rather than billing the actual time spent performing that service.

Ciena Healthcare Management 1.25 8/20/2007 Improperly billed Medicaid and Medicare for inadequate care of and services to residents at four metro Detroit nursing homes.

Bli Farms, Richard Bli and the estate of James E. Bli 1.229 11/29/2006 False crop insurance claims.

Lancaster Community Hospital 1.2 6/8/2007 Knowingly overbilled Medicare for physical therapy costs.

Lakewood Cheder School 1.2 10/31/2006 False information to obtain funds for preschool lunch program.

Robert E. Eberhart and Jonathan Holzaepfel, orthopedic surgeons and partners in

Seacoast Trust, and Thomas King 1 3/8/2007 HealthSouth paid higher than normal rent equivalent to income from referrals made by the doctors

Parkway Hospital, Inc 1 8/14/2007 Inflated hospital costs reports.

Environmental Management Inc. 1 4/2/2007 Overbilling and illegal disposal of chemicals in methamphetamine lab cleanups for DEA.

Dey 1 4/4/2007 Settlement of Hawaii FCA marketing the spread cases

Julio C. Melo, M.D., 0.984 7/23/2007 Billed Medicare for Evaluation and Management services that exceeded the number of hours there were in a day.

RightCHOICE Managed Care Inc. 0.975 1/31/2007 RightCHOICE paid higher fees to physicians serving government0insured patients than for other plans.

Comprehensive Cancer Centers 0.9 11/8/2006 Upcoding led to overbilling of Medicare for CCC services at Desert Regional Medical Center (owned by Tenet) X

Iftakhar Khan and Amjad Khan 0.825 1/9/2007 Owners of Livonia-based Michigan

Rehabilitation and Pain Management fraudulently billed Medicare. X

Green Valley Pavilion, LLC 0.55 5/14/2007 Forging and altering patient charts to maximize reimbursement from Delaware's Medicaid Program

Oregon Imaging Center 0.51 12/12/2006 Tests not ordered by doctor.

Moritz Embroidery Works 0.5 7/10/2007 False "Buy American Act" certification to the United States government for military and police emblems and patches.

John Dempsey Hospital 0.475 6/27/2007 Overbilled Medicare for chemotherapy treatment.

Colquitt Regional Medical Center 0.475 3/5/2007 Overcharged the government for services through CRMC's Home Health Office in Sylvester, GA X X

Hillsboro Area Hospital, in Hillsboro, Ill. 0.3 2/7/2007 Over billing for the treatment of Medicare beneficiaries who were diagnosed with pneumonia, sepsis, and renal failure. X

Beacon Ambulance Company. 0.219 3/29/2007 Use of one basic technician and a single Paramedic on ambulance run, and billing for two Paramedics.

Promark, Inc. 0.2 11/14/2006 Overstating warranty on epoxy paint to DoT

Riverview Cancer Center 0.165 10/5/2006 Upcoding and services not provided

LS Technologies 0.145 3/16/07 Submitted duplicate claims for two different subcontracts and was paid $50,000 based on these false claims.

Madison County, Alabama 0.11 2/19/2007 Diversion of money from "Working Connection," a welfare-to-work program.

Kansas City, Missouri School District 0.066 5/18/200 66,000 paid in money and over $13.6 in claims relinquished in E-Rate fraud case.

Armstrong Williams 0.035 10/22/2006 Failing to do contracted work for Dept. of Education

Dr. Roberto Ramirez 0.03 12/21/2007 False dental billing X X

Clark's Trading Company (Clark's 0.012 10/18/2006 Product substitution (meat) at Federal Bureau of Prisons.

Link:

http://www.taf.org/total2007.htm