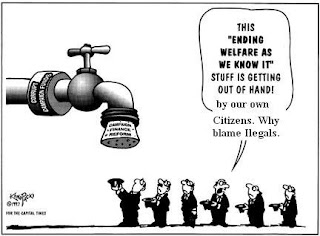

How many times did you heard that Undocumented Immigrants are responsible for draining Hospitals and social services like Medicare, Medicaid, Social Security Benefits. My point is when someone as a Citizen has been caught and supposedly committed fraud against those Social services has being protected by the Media, and by law under Presumed innocent unless and until proven guilty.

Since August 2006, more than 450 hospitals across the country were subject to fraud investigations and the Goverment has been recovered Millions.

Audits should be “particularly challenging from a provider perspective. The conditions for billing Medicare can be incredibly technical and a number of health care systems don’t always use the exact, correct language in their medical records and don’t have systems in place to ensure documentation is being done correctly” — which can lead to disallowed payments and payment recovery by the government against the provider.

Prosecuting health systems, hospitals and physicians for Medicare and Medicaid fraud was a priority during the Bush era, and should continue as a focus under the new administration.

With the Barack Obama administration taking office, Lucinda Jesson, director of Hamline University’s Health Law Institute, expects to see some shift in priorities from the Bush era. The Obama plan for more cost-effective health care is expected to include more emphasis on primary and preventive care but also should focus on effective regulations.

ANDERSON MAN CHARGED WITH DEFRAUDING THE INDIANA MEDICAID PROGRAM OF OVER $900,000

Timothy M. Morrison, United States Attorney for the Southern District of Indiana, announced that DENNIS LENNARTZ, 55, Anderson, Indiana, was charged with defrauding the Indiana Medicaid program, following an investigation by the U.S. Department of Health and Human Services, Office of Inspector General, the Federal Bureau of Investigation, and The Indiana Attorney General’s Medicaid Fraud Control Unit.

The information alleges that beginning in April 2006, DENNIS LENNARTZ, knowingly defrauded the Indiana Medicaid program of $964,852.59, by billing for services not actually rendered. In furtherance of his scheme, LENNARTZ concealed his involvement from Indiana Medicaid by billing under the provider number of another company.

"This case demonstrates the commitment of the Office of Inspector General working with our Federal and State law enforcement partners to protect our Nation's vulnerable Medicaid recipients," said Lamont Pugh III, Special Agent in Charge for the Chicago region of the U.S. Department of Health and Human Services Office of Inspector General which covers the State of Indiana. "Defrauding the Medicaid program isn't fair to the taxpayers who deserve accountability," said Attorney General Steve Carter. "Even more tragically, though, it wastes money that would otherwise provide healthcare for those who can't afford to pay."

According to Assistant U.S. Attorney Bradley P. Shepard, who is prosecuting the case for the government, LENNARTZ faces a maximum possible prison sentence of 20 years and a maximum possible fine of $250,000. An initial hearing has been scheduled for January 20, 2009 before a U.S. Magistrate Judge in Indianapolis, Indiana.

The information is an allegation only, and the defendant is presumed innocent unless and until proven guilty at trial or by guilty plea.

State Gets $67,000 in Medicaid Settlement

North Dakota Human Services officials say the state has received more than $67,000 as its share of a settlement with drug maker Cephalon, Inc.

Officials say the state`s share of $67,723 is part of a $425 million settlement involving the National Association of Medicaid Fraud Control Units and the federal government. The company was accused of illegally arketing three of its drugs.

Federal prosecutors, in announcing the settlement last fall, said Cephalon also agreed to plead guilty to one misdemeanor count of distribution of misbranded drugs.

Officials say the settlement reimburses the federal government and states for amounts paid by the Medicaid program as a result of the company`s improper marketing campaign. The program covers medical services for the needy.

The settlement includes a $375 million civil settlement and $50 million in criminal fines and penalties.